In the Futures, Options, and Strategizing in Today's Market webinar, we covered the basics of futures, options, and how to develop a grain marketing plan in today's market. See what questions other growers asked during the webinar and our answers:

Q: How does your strategy compare to a "scale up" strategy?

A: This strategy is designed to execute in a short period of time. The key difference is the Plan B feature. Scale up strategies allow producers to get to the level of sales that they are comfortable with without a Plan B. That usually is about 25-30% of projected production. To be successful, producers need to get 80%+ of their grain sold at targeted prices. A scale up system with a strong optionated Plan B would be a plan with a higher chance of success.

Note: optionated means a commitment to using options on futures, as an integral portion of a risk management strategy.

Q: What do you normally budget for options per year?

A: We would suggest budgeting $0.16 for corn, $0.35 for soybeans, and $0.20 for wheat. This is what we'd typically risk early in the season with the goal being to have the net cost under $0.10.

Q: Where would you recommend I look for education on grain marketing and to learn more about options?

A: Finding someone you trust such as a marketing consultant, broker, or friend who knows options is a great source for learning. You can also reach out to your University's local extension office. They often offer grain marketing seminars that also cover options. In addition, here are two books I'd recommend:

- Understanding Options by Michael Sincere

- Option Volatility & Pricing by Sheldon Natenberg

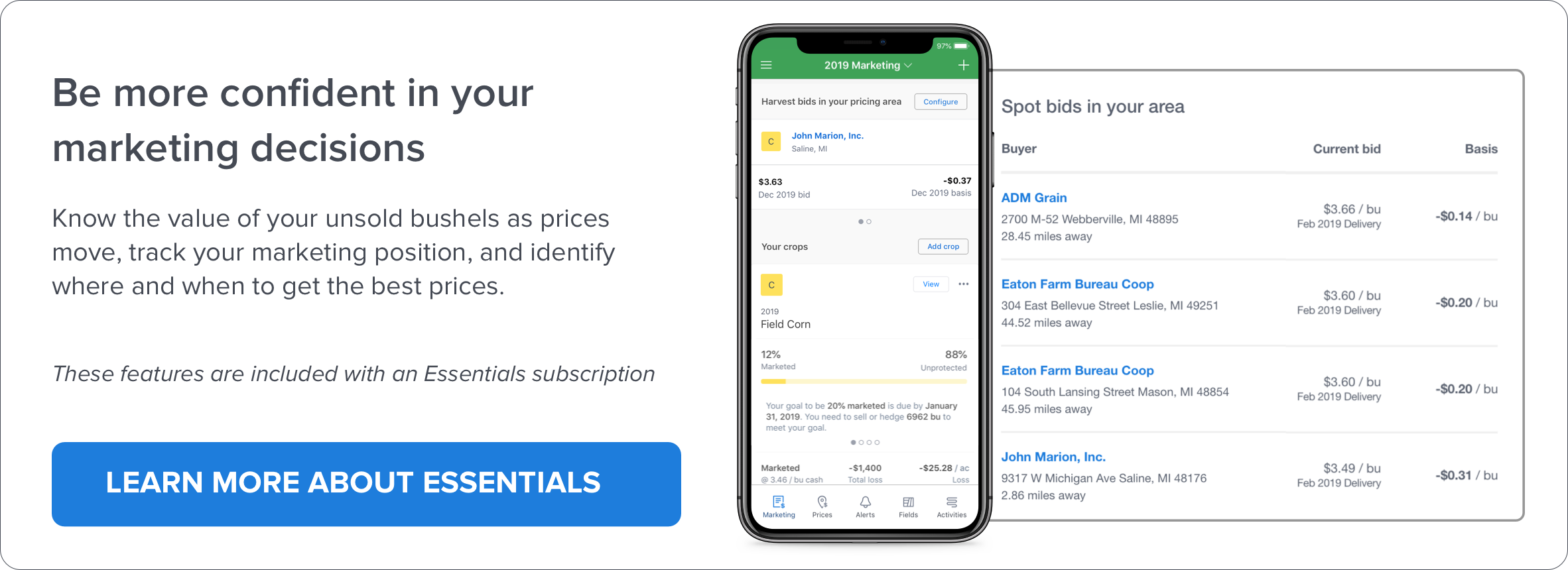

Learn about FarmLogs free Marketing software »

Visit our Crop Marketing Education page for more!

-2.png)